Investor Relations

Highlights 2024

GROUP PERFORMANCE OVERVIEW

The Group recorded a revenue of US$29,778 million, 7.2% below prior year. The devastating effects of the El Nino induced drought, introduction of the new currency (ZWG) and its subsequent devaluation in September 2024, along with tight liquidity have had a knock on effect across all the Group Business Units, particularly in the Agricultural Sector. The resultant loss before tax was US$3,437 million, having achieved a profit in the prior year.

OUTLOOK AND STRATEGIC FOCUS

The Group has vigorously pursued cost cutting measures, re-examined supplier pricing and actively sought new suppliers for fast moving stock items in an effort to remain competitive. The effects of the El Nino drought will still be felt during 2025 in the agricultural sector, and tight liquidity is expected to persist. The impact of the informal market will continue to be felt by TrenTyre and CT Bolts, but measures to be more price competitive, offer the best- in-class service and lower overheads are expected to translate to profitability. Late rains in the 2024/25 season have delayed infrastructure and mining projects, and coupled with persistent power outages, the cost of doing business will impact the entire market. Softer platinum and Chrome prices have delayed several large projects. Chinese mines, which currently make up approximately 80% of all mines, generally buy exclusively from Chinese suppliers, reducing the rest of the mining equipment suppliers to 20% of the market, which leads to further pressure on margins…..

Dear Stakeholders

I am pleased to present to you the Group’s financial results for the year 2024.

Operating Environment

The tough operating environment that persisted in the period under review, characterised by the poor 2023/2024 cropping season due to the El Nino induced drought, US$ inflation and currency related challenges had a notable adverse impact on the financial performance of the Group. In April 2024, Monetary authorities introduced a raft of measures which included the introduction of a new currency, the Zimbabwe Gold (ZWG), in order to restore exchange rate stability and to address market volatility. However, the depreciation of the local currency in September 2024 caused severe disruptions in trading activities as liquidity dampened, resulting in a resurgence of inflationary pressures.

Group Financial Performance

The 2024 financial year saw the Group’s performance swing from a profit position in the prior year to a loss before tax of US$3.4 million in the period under review attributable to TrenTyre and the agriculture related business units. The agriculture related business units collectively contributed 96.6% of the operational losses. Volumes across all product ranges within the Agriculture Cluster were depressed due to the severe impact of the 2023/2024 El Nino induced drought which resulted in reduced consumer spending. This was further exacerbated by the late onset of the 2024/2025 agricultural season which was characterised by an erratic rainfall pattern, particularly in the fourth Quarter of 2024. TrenTyre’s financial performance was adversely affected by persistent supply chain bottlenecks coupled with the informalisation of the tyre industry………

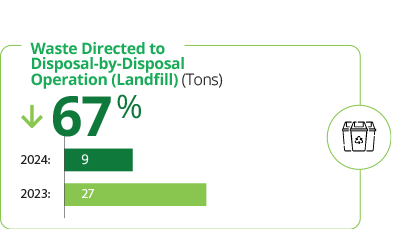

*Ground water and waste directed to disposal-by-disposal operation (Landfill) figures are based on estimates.